Introduction

Liquidity is the cornerstone of efficient financial markets, enabling seamless trading and price stability across exchanges. However, many exchanges face significant challenges in maintaining consistent liquidity across many types of assets. As digital assets and the tokenization of real-world assets become more common, this problem will only increase. Insufficient liquidity leads to higher bid-ask spreads, increased price slippage, higher volatility, and reduced trading efficiency, ultimately discouraging user participation. Furthermore, fragmented liquidity across multiple exchanges creates inefficiencies, as traders must navigate multiple platforms to find the best execution, increasing costs and reducing market transparency.

In the cryptocurrency space, current solutions, such as liquidity pools and market makers, address some of these challenges but introduce their own limitations. Automated market makers (AMMs), commonly used in decentralized finance (DeFi), suffer from impermanent loss and inefficient capital allocation. Centralized exchanges rely on high-frequency trading firms, designated market makers, and omnibus wallets, which can result in monopolistic behaviors or withdrawal of liquidity during volatile conditions. These systemic issues underscore the need for an innovative approach to liquidity provisioning—one that enhances market depth, reduces inefficiencies, allows for liquidity to be applied across exchanges, and fosters a more resilient trading environment across all types of exchanges and all types of assets.

In parallel with liquidity concerns for exchanging assets on an exchange, there are other situations where an efficient solution providing for the immediate exchange of assets can be valuable. The development of efficient payment solutions using digital assets, where various digital assets can be used for payments, is an example of another opportunity but demonstrates additional challenges as well. One major hurdle is the volatility of digital currencies, which complicates their use as a reliable medium of exchange. Unlike fiat currencies, which benefit from relative price stability, cryptocurrencies experience frequent and unpredictable fluctuations that can affect purchasing power and settlement values. This volatility necessitates complex hedging strategies or the use of stablecoins, which introduce their own set of risks, including regulatory scrutiny, the security of underlying bailment solutions, and dependency on centralized issuers.

Another critical challenge is transaction speed and cost, particularly for blockchain-based payments. While traditional payment networks process transactions within seconds, many blockchain-based solutions suffer from scalability issues, leading to network congestion, high fees, and slower confirmation times. Layer-2 solutions and cross-chain interoperability protocols aim to mitigate these issues, but adoption remains inconsistent across different platforms and jurisdictions. Additionally, regulatory uncertainty surrounding digital asset payments further complicates mainstream acceptance, creating barriers to integration with existing financial infrastructure and limiting the potential for widespread adoption. Further, there is a challenge when customers want to pay in one type of digital asset, but sellers want to receive a different type of digital asset as payment.

Given these challenges, there is a pressing need for a system that can quickly and efficiently exchange and transfer digital assets.

DevvISE is a system that integrates a dynamic liquidity mechanism with an adaptive digital asset payment framework. DevvISE not only enhances liquidity distribution across exchanges but also establishes a more stable and efficient digital payment infrastructure, and implements a scalable and secure lending system, all of which pave the way for broader adoption of digital assets in financial transactions.

DevvISE Overview

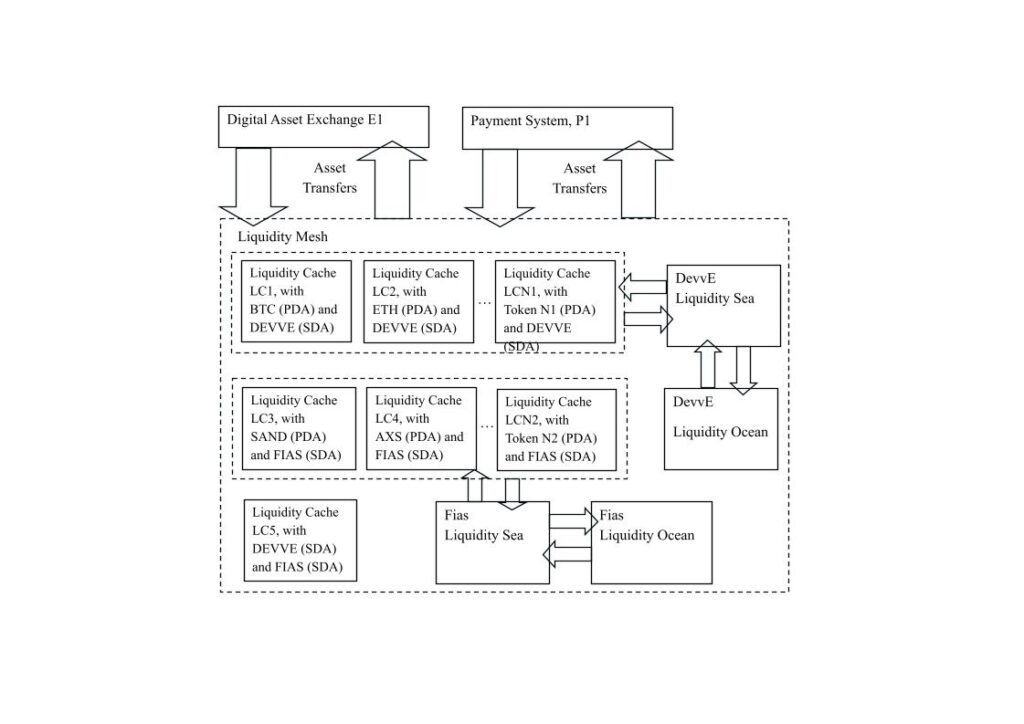

DevvISE is a patented liquidity provisioning system underlying DevvExchange. It is comprised of Liquidity Caches (LCs) which can be used to provide for market making, instant conversions of one asset to another, and lending, as examples.

Users contribute to Liquidity Caches, where assets are held and utilized in coordination with DevvExchange. A Liquidity Cache includes a Primary Digital Asset (PDA) such as Bitcoin and Ethereum, and a Shared Digital Asset (SDA) including DevvE and Fias. The use of these assets creates revenue in various ways:

- Market Making: PDAs are used for market making activities with DevvExchange. Users that contribute PDAs share in the revenue created from the market making activity. Contributors to Liquidity Caches share in market making revenue.

- Instant Payments: Liquidity Caches are used to instantly convert any PDA to any other PDA through the use of SDAs. For example, DevvE can be used to convert Bitcoin to a stablecoin instantly with no counterparty risk. This functionality is ideal when exchange transactions need to be immediate, such as in a payment system. Contributors to Liquidity Caches share in payment fees.

- Lending: DevvISE’s lending system allows for lending and borrowing of crypto assets. The lending technology allows for riskless access to collateral on loans and on-chain contractual definitions managed at the core consensus level, rather than on smart contracts. The approach dramatically reduces risk and gives much better tax strategies compared to existing DeFi lending protocols. Liquidity Cache contributors can share in revenue created using our innovative lending programs.

- Exchange Fees: Contributors to Liquidity Caches share in the revenue created by DevvExchange itself, from traditional exchange fees.

DevvISE and DevvExchange are unique in their philosophy for growth – it is the first traditional regulated exchange system built on the premise of sharing in growth and upside with the community. Users can contribute to LCs and share in the revenue of the entire system.

How Does DevvISE Work?

DevvISE operates with several automated systems that utilize the assets in Liquidity Caches across various purposes. An Automated Market Making System adds limit orders to the DevvExchange order book through standard market making operations. A lending protocol allows for the lending of assets with on-chain legal contracts that eliminate risk to lenders for collateral. If an immediate payment is needed, a Payment Control System implements instant exchanges of assets.

For example, a Liquidity Cache’s assets can be used for lending, where a loan is defined on-chain and the collateral for a loan is secured at the consensus level. Assets do not need to be transferred into smart contracts, which can create unwanted tax consequences – the DevvISE system operates at the consensus level rather than at a smart contract level, therefore removing some of the most significant risks of security hacks. Collateral remains in a borrower’s account unless there is a default on the loan, and it is locked until the loan is fully paid off. Lenders therefore have absolute security within the lending platform. As with all of the activities within DevvISE, LC contributors share in the upside of the use of those funds. In Liquidity Cache lending pools, all of the ownership of assets are fully known and KYC’d, assets are fully protected with private key loss protections, theft protections prevent assets from being stolen through hacks, and the system includes privacy and a protective bailment solution. Overall, this is a good example of how DevvExchange can bring the innovation and power of DeFi into a context where TradFi institutions have the necessary protections required to take part in these types of systems.

Similarly, if a user wants to buy a cup of coffee at a coffee shop with Bitcoin, a scan of a QR code or a swipe of a credit card can trigger a series of transactions that all settle instantly using DevvExchange’s Contingent Transaction Sets. First, in order to buy the cup of coffee, a user’s Bitcoin is sent to the LC with DevvE and Bitcoin. That releases DevvE, through a mechanism similar to the operations of a Liquidity Pool, that is then sent to a DevvE and USD stablecoin Liquidity Cache, which releases USD. Then the USD is sent to the merchant. All three of those transactions are included in one Contingent Transaction Set, and all three go through at the exact same moment as part of a set controlled by the Payment Control System, therefore removing any middlemen or settlement risk. In this way, Shared Digital Assets like DevvE and Fias can be used to convert any asset into any other asset, instantly, without risk. Again, the assets held in wallets for payments include loss and theft protections, and users can pay directly with their assets, without having to top-off into fiat, and all while directly maintaining their direct access through private keys.

Because DevvExchange and DevvISE coordinate the use of assets for market making, lending, payments, and other uses, the overall system is incredibly powerful. LCs can be rebalanced removing risk around impermanent loss for immediate exchanges. Investors can put funds into LCs knowing that the system has guardrails and balancing mechanisms which keep assets within statistical requirements, while still making a strong return on investment on contributions to LCs.

If users want to contribute Shared Digital Assets like DevvE and Fias, they can contribute to Liquidity Seas which are used to create balance across collections of LCs that share those SDAs. Contributions into Liquidity Seas then share in the various types of revenue created by DevvExchange and DevvISE. Additionally, even when contributed to a Liquidity Cache, DevvE and Fias can be used as collateral on loans, giving particular utility to these tokens where the assets can generate revenue, but also where the underlying value can continue to be used. DevvE and Fias have the most utility in the system over any other token as they have these unique features and share across more revenue streams in the system than any other token type. Further, DevvE is the method of payment for all DevvExchange fees, and using it directly (rather than through conversion) reduces fees for users.

All of the features for all tokens used with DevvExchange and DevvISE include all of the key features and protections of the system.

- Users control their assets at all times. All interactions are non-custodial. Users can even trade using hard wallets, for example, where they maintain custody of assets that are sent and assets that are received during instantaneous settlement in an exchange transaction. A key philosophy of DevvExchange and DevvISE is “not your keys, not your crypto”.

- Users have full protection on all of their assets however they are used. Private key loss protection, and theft protection combined with lending, together allow for a user to be fully secure and safe irrespective of private key management itself. This is a revolutionary concept for blockchain, and will change the mentality of how the space thinks about safety.

- Privacy is a core aspect of the platform, but it is implemented in a way that is regulatory compliant.

- The bailment solution for DevvExchange protects the assets underlying wrapped tokens so that even if a platform goes into bankruptcy, users can still be fully assured that they have access to their assets.

- Our approaches eliminate many attack vectors like MEV and front running. We provide innovative solutions to prevent naked short selling and other types of manipulation.

Decentralized Finance has proven to be innovative and a high growth category, but it has not been available to Traditional Financial institutions before now, given the risks and lack of regulatory compliance in the DeFi space. We provide crypto without chaos. We bridge between the innovation and demand for DeFi, and the security and safety of TradFi. We provide best-in-class opportunities to earn while also providing best-in-class security and regulatory compliance. We provide not only the next generation of user protections beyond even what TradFi gives, but fundamentally, we provide for the next generation of digital asset exchange, digital asset ownership, and the next generation of tokenization capabilities.